As markets reel from tariff tensions and political interference, business leaders are poised to break their silence and push back against Donald Trump's economic policies.

The U.S. stock market took another beating on Monday, with the Dow dropping 972 points and the dollar hitting a three-year low, according to CNN. The widespread sell-off came as investors reacted to ongoing tariff uncertainty and President Trump's escalating feud with Federal Reserve Chair Jerome Powell.

Trump's recent attacks on Powell, including labeling him a "major loser," and efforts to pressure the Fed to lower interest rates have rattled Wall Street and undermined global confidence in U.S. financial leadership.

On top of that, stalled trade talks—most recently with Japan—and a broader "trade war with everyone" approach have deepened investor anxieties. Major indexes have now recorded their worst monthly performance since 2022.

Analysts cite the combination of unsteady trade policy and political interference in monetary policy as driving the market chaos.

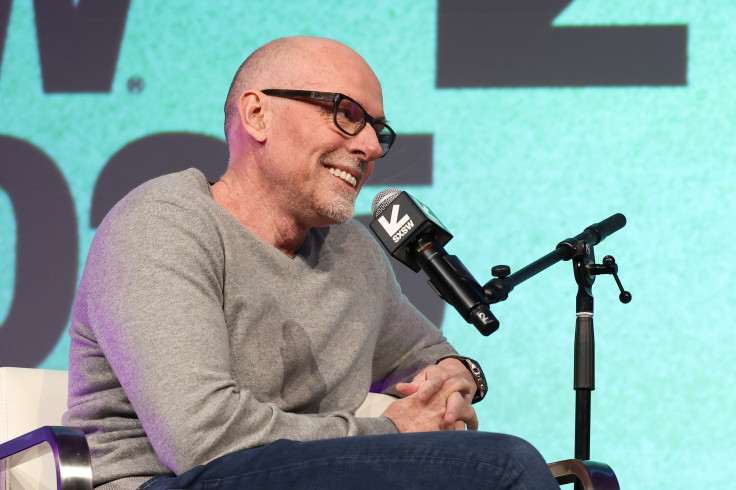

NYU business professor Scott Galloway believes top executives are reaching a breaking point, Mediate reported. On his "Pivot" podcast, Galloway predicted that in the coming weeks, a wave of Fortune 500 CEOs and possibly even some Republican lawmakers will begin publicly criticizing Trump's actions.

"But I think you're going to see in the next one or two weeks, a cadre of Fortune 500 CEOs, Republicans stand up, business leaders stand up and say, okay, enough already. While you all claim he's playing 4D chess, at this point we're worried he's going to start eating the pieces. This guy is making the stupidest decisions," Galloway said.

If Galloway's forecast proves correct, this could mark a significant turning point in corporate America's relationship with Trump.

© 2025 Latin Times. All rights reserved. Do not reproduce without permission.