SEATTLE - As part of his first decrees when he is sworn in as the 47th President of the United States, Donald Trump has continuously promised to impose tariffs on imports from Canada and particularly Mexico until its geographical neighbors curb the flow of illicit drugs and undocumented immigrants crossing its borders.

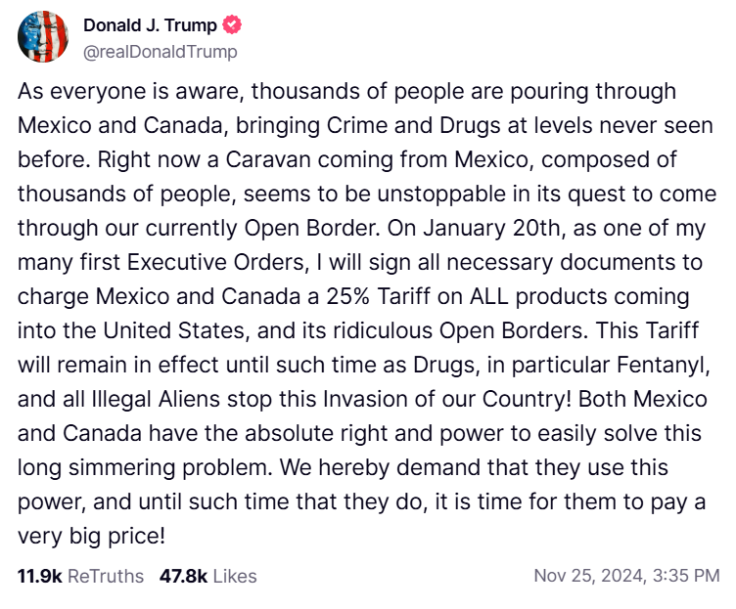

On his Truth Social account, President-elect Trump accused Mexico and Canada of "bringing crime and drugs" into the U.S. and continued to suggest he would impose "a 25% tariff on all products coming into the United States" starting January 20, the day of his inauguration.

Although tariffs have been one of Trump's major talking points since winning the election, economists believe such measures would increase the cost of products for consumers in the U.S.

Dr. Jeremi Suri, award-winning global affairs lecturer and author, recently told The Latin Times that tariffs could actually inflict greater damage on the U.S. economy by disrupting supply chains in key industries, reducing production efficiency, and straining international trade partnerships.

A couple of key industries that would be affected by such tariffs are the drilling and refining industries. And according to a Reuters report, lobbying groups within the energy industry have already warned of the significant impact these would have across the board.

"Trade policies that could inflate the cost of imports, reduce accessible supplies of oil feedstocks and products, or provoke retaliatory tariffs have potential to impact consumers and undercut our advantage as the world's leading maker of liquid fuels," a spokesperson for the American Fuel and Petrochemical Manufacturers group told Reuters.

Also known as AFPM, the group is the leading trade association representing the manufacturers of fuels, petrochemicals and midstream companies in the U.S.

The AFPM added its industries would "continue urging officials to veer clear of any policies that could disrupt America's energy advantage," a similar position from the one the organization took when Trump won the 2024 presidential elections.

On Nov. 6, AFPM President and CEO Chet Thompson issued a statement in which he said the U.S. required "a policy environment that allows American energy to compete globally, innovate for consumers, and extend U.S. energy leadership and security for the betterment of the American people."

The American Petroleum Institute was another group that shared its concerns over the planned tariffs. Scott Lauermann, a spokesperson for API, said both Canada and Mexico remained the U.S.'s top energy trading partners and that maintaining the free flow of energy products across North America was "critical" for the region's energy security as well as for U.S. consumers.

As Lauermann suggests, having a good relationship with both Mexico and Canada should be critical for the Trump administration,

Canada is the top oil supplier to the United States, sending nearly 4 million barrels of crude per day last year.

Similarly to Canada, Mexico plays a key role in the United States' energy trade totals. U.S. crude oil imports from Mexico averaged 733,000 barrels per day in 2023, a 15% increase compared to 2022.

In 2023, Mexico was the largest export market for U.S. petroleum products, including gasoline, diesel fuel and propane.

Mexico was the largest export market for U.S. petroleum products in 2023, including gasoline, diesel fuel and propane.

© 2025 Latin Times. All rights reserved. Do not reproduce without permission.