Latino household wealth rose to $63,400 in 2022, with homeownership and self-employment as two of the main drivers, according to NAHREP's latest edition of the State of Hispanic Wealth Report.

NAHREP highlights that homeownership is the largest contributor to wealth, with Latino families who are in this category "having, on average, 26.4x the net worth of those who rent."

However, the other side of the coin is that the same rapid home appreciation that drove wealth creation also "inflated a growing affordability crisis and have raised the barrier of entry to homeownership for first-time buyers."

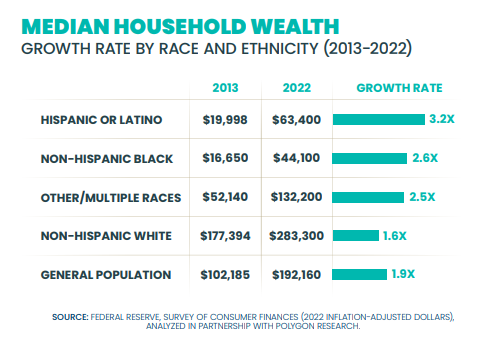

Latino wealth tripled since 2013, a much rapid pace that the rest of the demographics in the U.S. But it's still far away and less than a third than the general population median, which was of $192,160 in 2022.

Non-Hispanic Blacks stand below on the list, with a median household wealth of $44,100. Non-Hispanic Whites are at the other end of the spectrum, with $283,300, while the "other/multiple races" category standing in the middle with $132,200.

"In 2022, non-Hispanic White households held on average $4.47 for every $1 held by Latino households, compared to $8.87 back in 2013. While this is promising, the gap is simply not shrinking quickly enough," reads a passage of NAHREP's report.

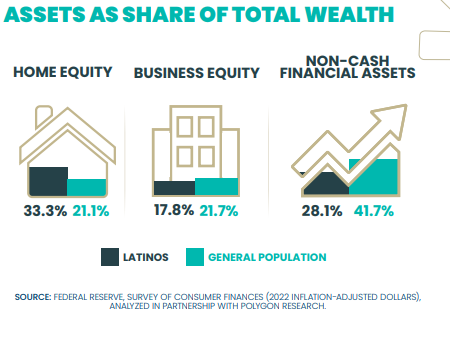

When breaking down the composition of Latino wealth, home equity stands out as the main source, representing 33.3% compared to the general population's 21.1%. Business equity and non-cash financial assets hold lower significance for Latinos than the rest: the former represents 17.8% of their total wealth compared to 21.7% of the general population. For the latter, percentages are 28.1% for Latinos and 41.7% for the rest.

"Home prices have skyrocketed in recent years, with dramatic acceleration during the COVID-19 pandemic. In 2013, the median sales price of homes sold in the United States was $266,225. By 2020, this figure had risen to $336,950. By 2022, the median sales price reached nearly half a million dollars at $457,475," the report recalls. The unsavory aspect, as mentioned, is the increasing unaffordability renters face to buy a first home.

The report also delves into investment property as a way to increase wealth beyond homeownership. It highlights that between 2013 and 2022 the share of households owning investment properties increased from 7.3% to 9.5%.

"Between 2013 and 2022, all the growth in investment property ownership came from non-White households, with Latino, non-Hispanic Black, and households classified as other or multiple races experiencing a significant uptick," the report adds, specifying that, "since 2013, the median value in investment property ownership held by Latino households has nearly doubled, rising from $87,100 in 2013 to $160,000 in 2022.

"Among all racial and ethnic demographics, Latinos, by far saw the largest rise in median investment property values," it adds.

In another section, NAHREP delves into the importance of self-employment for Latino wealth, noting that "whether out of necessity or traditional entrepreneurial spirit, the number of Hispanic-owned businesses rose dramatically during the pandemic." Concretely, it did so by 64.6% between 2019 and 2022. Most of them remain relatively small, with 92% of them having fewer than 10 employees.

However, despite the increase , "the overall wealth of self-employed Hispanic families decreased" by 44% during the mentioned period. "Though this rapid decrease appears alarming, it is not surprising, given that the vast majority of these additional one million new businesses which have fewer than 10 employees each, take time to ramp up," the report clarifies.

On another hand, business equity saw significant growth during the pandemic, growing from $114,822 to $158,000, or 37.6% when taking inflation into account. "While business equity growth is a positive trend, self-employed Latinos have the lowest median value compared to other demographic groups," according to the report.

© 2025 Latin Times. All rights reserved. Do not reproduce without permission.