The IRS is working with ICE and sharing personal tax information that could get undocumented immigrants deported after a deal between the agencies. The move is expected to discourage tax-paying migrants from submitting tax declarations this year, with economic experts predicting a multi-billion loss in taxpayer revenue.

According to the Institute on Taxation and Economic Policy, undocumented immigrants contributed $96.7 billion in taxes in 2022, with nearly $60 billion going straight to federal programs and services.

Experts warn that if immigrants stop filing taxes out of fear, the results would be economically devastating. Just a 10% decrease in immigrant tax filings would mean a loss of $9.5 billion annually.

Tom Bowman from the Center for Democracy and Technology told NBC News that this move will significantly decrease compliance, impacting everyone who relies on federal services like Social Security and Medicare—programs immigrants themselves can't even benefit from.

Background

The IRS and Immigration and Customs Enforcement (ICE) have agreed to share previously confidential tax information of taxpayers who are in the country unlawfully, flipping the script on a decades-long promise of privacy. This decision could facilitate immigration enforcement agents with finding undocumented immigrants faster, as information such as their home and work addresses can now be disclosed.

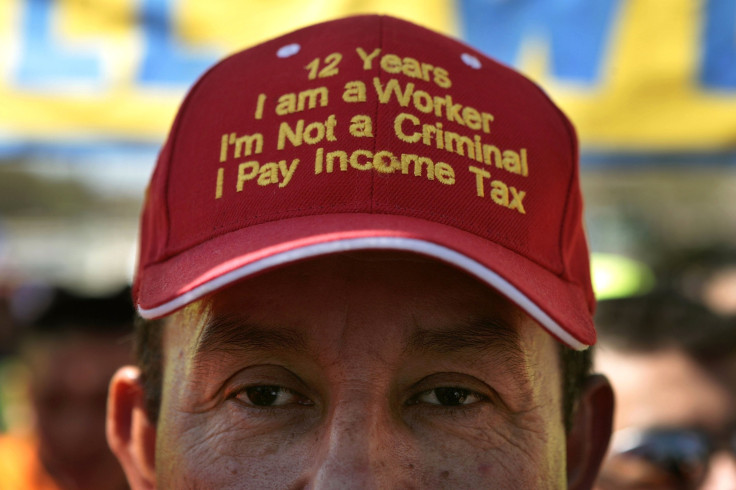

Many advocates, lawyers, and immigrants are calling it a betrayal. Undocumented taxpayers have long believed that paying taxes–despite not being able to benefit from federal services–is considered a demonstration of good faith. For years, immigration lawyers have advised immigrants to file their income tax declarations, assuring them that their information would not be used for deportation purposes.

Some immigration lawyers have advised immigrants who plan to file their taxes despite the federal agreement to do so without including their home address.

"I tell my clients that maybe a good idea is to not share your home address and instead use a different one that might be a safer option so you are not exposed to a possible deportation," Alex Galvez, founder of Immigration Law Practices in Los Angeles, California told Telemundo.

Several organizations have sued the Department of Homeland Security (DHS), ICE and their top officials over the measure. Tax information has generally been closely held within the IRS, and laws prohibit improper disclosure of taxpayer information.

Various IRS leaders have stepped down over their disagreement with the sharing of agency data with ICE, with more planning to follow suit, The New York Times Reported.

© 2025 Latin Times. All rights reserved. Do not reproduce without permission.