The latest Survey of Consumer Finances (SCF) revealed that the "typical Hispanic family similarly held only about 20 percent (about $61,600) of the wealth of the typical white family ($285,000)" in 2022.

However, that disparity is not distributed evenly across this demographic, which is far from being a monolith. A new study by the Brookings Institution analyzed how the Latino wealth gap when compared to Whites varied in six states in 2021: it showed that in Illinois Whites have 1.9 times as much wealth than Latinos, while in New York it soars to a whopping 40.

The other states featured in the study were Texas, where white households had three times the wealth of Latino households; North Carolina, where it was 3.6 times; Florida, with five times and nine in California.

These can be explained largely by the variation in Latino wealth in the different states. The research shows that Latinos' median household net worth in Illinois is $158,800 —significantly higher than the other states: it was $75,600 in Texas; $55,900 in North Carolina; $54,200 in Florida; $52,700 in California; and $5,900 in New York.

The factors that could explain this vary and range from national origin; the length of time they have been in the country; their immigration or citizenship status; and state and local ones, among others.

Regarding the first one, national origin group, the report highlights that there are tangible wealth disparities within the Latino community. In Illinois, most Latino residents are Mexicans. In New York, the report focuses on the large Afro-Latino population and the "structural disadvantages they face".

"For example, research shows that despite their higher educational attainment and participation in the labor market, Afro-Latinos experience anti-Blackness in the economy and society, which impacts household incomes and homeownership", reads a passage of the study.

In Illinois, meanwhile, Latinos' ability to build wealth "may be attributed to homeownership opportunities and settlement patterns in the state, particularly in the suburbs", says the paper, which cites a range of figure to back up its claim: "The Latino Policy Forum found that more than 50% of Illinois' Latino population lives in the suburbs. Additionally, 47% of Latino households in the suburbs earn more than $75,000, and 60% of Latinos living in suburbs own their homes."

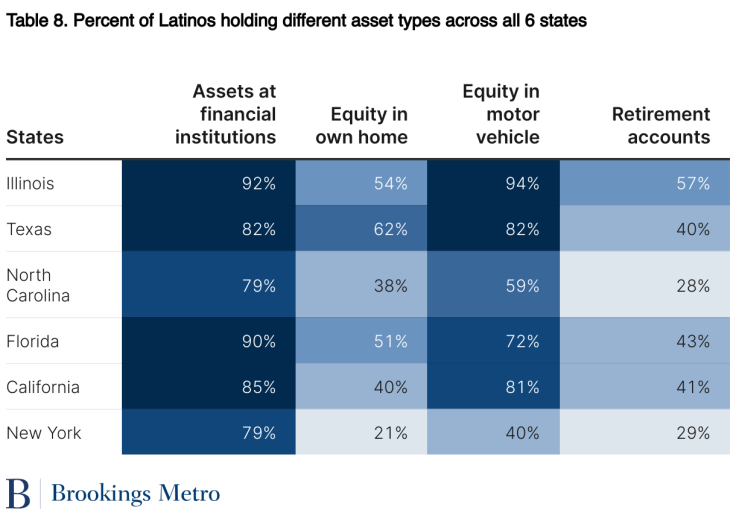

In New York, in contrast, the gap can be explained by "the significantly smaller percentage of Latino households holding any type of assets compared to the share of white households, who hold an array of assets."

Finally, the study claims that examining how credit and debt impact Latinos is key to understanding their ability to create wealth.

"Unfortunately, not everyone has access to "good" forms of debt, and there are also many racialized dimensions of debt. Scholars such as Louise Seamster find that 'good debt' correlates highly with 'white debt,' while 'bad debt' correlates highly with 'Black debt'—especially as white families tend to have more "good debt" than Black and Latino families," the research explains.

"Meanwhile, Black and Latino people are more likely than white people to depend on "bad debt," including alternative financial services such as payday loans and title loans, because there are fewer banks in Black and Latino neighborhoods. Given the racial diversity among Latinos, it is worth further exploring how structural advantages or disadvantages may lead Latinos generally—and Afro-Latinos in particular—to encounter "good debt" versus "bad debt," it adds.

More data and research are needed to understand how debt affects Latino households, concludes the study with regards to this area.

© 2025 Latin Times. All rights reserved. Do not reproduce without permission.