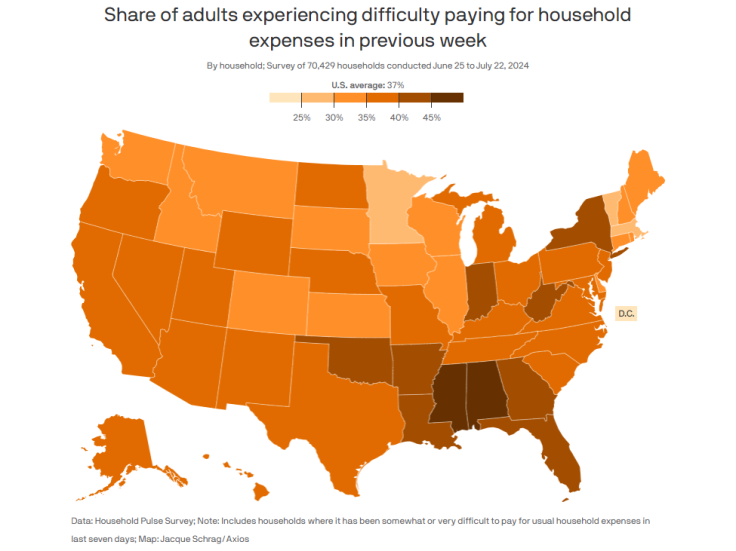

SEATTLE - Even though inflation is down to the peak experienced during the COVID-19 pandemic, about 37% of American adults find themselves in a somewhat difficult position to pay for typical everyday expenses. That number is higher among Florida adults, with 41.8% having a harder time making ends meet.

According to data form the U.S. Census Bureau's Household Pulse Survey, people in the Southeast are facing a tougher challenge than other Americans across the country.

The online survey found that Mississippi (49.5%) leads the nation in terms of adults who say they are having trouble affording basic needs, while Alabama (45.5%) and West Virginia (43.5%) complete the podium.

Difficulties to pay for basic needs in Florida and other states in the Southeast continue a trend that has troubled the 'Sunshine State' in the last few years.

A 2022 report by United Way found that, of the 8.8 million households in Florida, four million were either in poverty or unable to afford basic living costs. Minorities had a tougher time making ends meet, with 60% of Black and 52% of Latino households in Florida ranking below what the United Way calls the ALICE threshold — an acronym that stands for asset limited, income constrained and employed.

The high cost of living plus an increase in prices has complicated things for Floridians, whose minimum cost of household necessities for a single adult increased from $28,344 to $30,084, while a family of four's minimum cost rose from $66,324 to $81,120 between 2021 and 2022, according to the United Way report.

Earlier this year, research from Forbes Advisor found that, on average, the cost of living for a single adult in Florida was $40,512 while the disposable income of Floridians, the amount of money an individual or household has left after paying taxes and other expenses, was just $19,704, ranking 37th among the U.S. states.

Although Florida has attracted a record number of new residents in the past few years, high prices in groceries and mortgages might drive some people out of the state in the near future.

According to a report from the National Low Income Housing Coalition, a worker in Florida making minimum wage at an hourly rate of $12 would need to work 98 hours per week to afford a one-bedroom rental home at a fair market rate.

While speaking to FOX 13, Georgie Chijioke, a millennial Floridian, explained how he still needs to supplement his income to live comfortably despite earning more than the minimum wage.

"I make a decent amount of money, however, it's not enough. I love it down here, but it's just... it doesn't make sense anymore," Chijioke said. "My car insurance went up, my cable went up, you know, the gas went up. Everybody's struggling. They're working three, four, five, six jobs, you know. It's ridiculous."

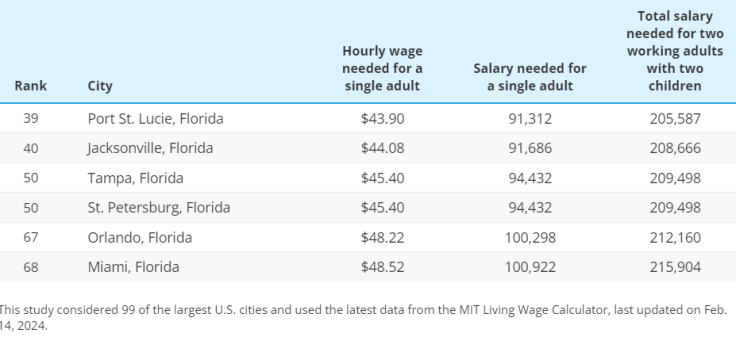

A recent report by Smart Asset found that, on average, an individual needs $96,500 for sustainable comfort in a major U.S. city. That number is based off on the 50/30/20 budget strategy, which recommends that 50% of your salary should be allocated to things such as housing, groceries and transportation; 30% towards entertainment and hobbies; and 20% toward paying off debt, saving or investing.

Using the site's data, no Florida city ranked within the top-20 in terms of affordability. In fact, major cities in the 'Sunshine State' require residents to make north of $90,000 for single adults to live comfortably. The city of Miami had the highest salary needed for a single adult, requiring people to make more than $100,000 on average in order to live there.

© 2025 Latin Times. All rights reserved. Do not reproduce without permission.