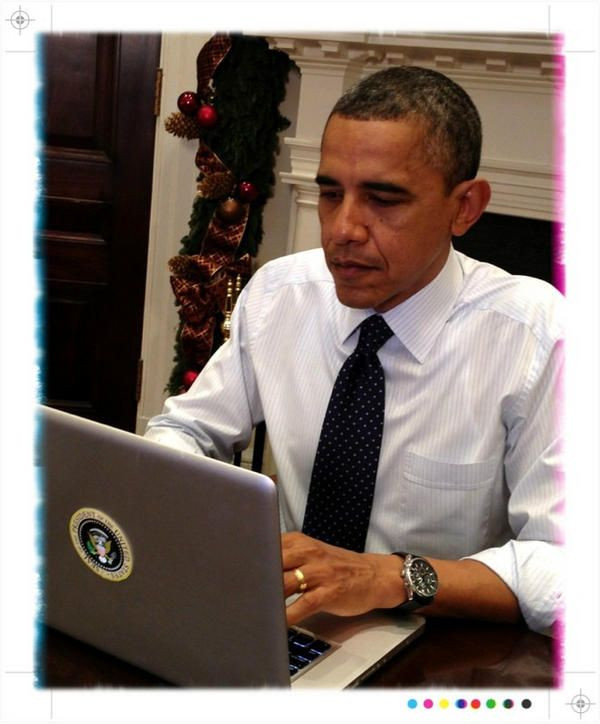

On Monday afternoon, President Obama hosted a question and answer session on Twitter about extending middle class tax cuts.

According to the White House, if Congress fails to act before Dec. 31, every American family's taxes will automatically go up and a typical middle-class family of four would see its taxes rise by $2,200 starting in 2013.

"hey guys - this is barack," the president tweeted. "ready to answer your questions on fiscal cliff & #my2k. Let's get started. -bo"

One person asked if Obama can assure the American people that any "fiscal cliff" negotiations regarding entitlement reform will not hurt the most needy.

The president said "we can reduce deficit in balanced way by ending tax cuts for top 2% + reforms that strengthen safety net & invest in future."

The president said high end tax cuts do least for economic growth and cost almost $1 trillion and extending middle class cuts boosts consumer demand and growth.

House Speaker John Boehner said right now, the president and Congress are "nowhere, period."

According to ABC News, "Obama is insistent that rates rise on individuals earning more than $200,000 a year and families making $250,000 or more. Boehner and Republicans are staunchly opposed."

David Osteen asked the president why not place more emphasis on reducing government spending, than on raising revenues.

Obama said that over $1 trillion in government spending was cut last year and discretionary spending is at "lowest as % of GDP since ike." The president said he is open to more smart cuts but not in areas that help growth and jobs or hurt the vulnerable.

Obama said Americans should not expect his budget to pass 100 percent and there is room to negotiate.

"If you incl $1T+ in cuts already made, rough balance b/w rev & cuts does trick," Obama wrote.

In his weekly address on Dec. 1, Obama urged Congress to extend the middle class tax cuts.

"Congress can pass a law that would prevent a tax hike on the first $250,000 of everybody's income" Obama said. "Everybody. That means that 98 percent of Americans and 97 percent of small businesses wouldn't see their income taxes go up at all. And even the wealthiest Americans would get a tax cut on the first $250,000 of their incomes."

The president said it is "unacceptable for some Republicans in Congress to hold middle class tax cuts hostage simply because they refuse to let tax rates go up on the wealthiest Americans."

© 2025 Latin Times. All rights reserved. Do not reproduce without permission.