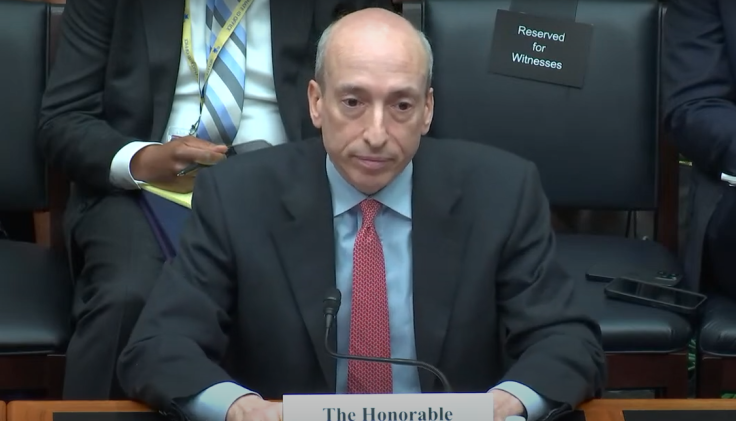

U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler has been under extreme pressure in recent days following Wednesday's scathing hearing at the House Financial Services Committee.

On Thursday, the SEC chief appeared at CNBC's Squawk Box, discussing his views on the cryptocurrency industry, and affirming that Bitcoin, the world's largest digital currency by market value, is "not a security."

Gensler Affirms Bitcoin's Status as a Commodity

In the interview, co-host Joe Kernen said he thinks Gensler was "warming up to top tier crypto," suggesting that the regulatory chief was recognizing the potential benefits of some top crypto assets.

"I think you think there might be some actual usage or benefit to top tier crypto," Kernen pointed out. Gensler said, "No, no, no." Kernen pressed him further, specifically mentioning Bitcoin, until the former investment banker cracked.

"As it relates to Bitcoin, my predecessor and I have said that's not a security. You now have a way that you can actually express that view. Buy into that through exchange-traded products (ETPs). Trade it on Nasdaq. Trade it on the New York Stock Exchange and the like," Gensler responded.

Co-host Andrew Ross Sorkin asked the SEC chair where he thinks Bitcoin will be in society after 20 years, to which Gensler refused to provide a prediction. He did say that the "field [of crypto] is gonna have a challenge building trust."

A Look Back at Gensler's Bitcoin Views

Gensler's statements Thursday come in the back of extreme pushback from the crypto community each time the Commission files a lawsuit against another digital asset provider or it issues a Wells Notice to crypto firms.

Kernen's comments Thursday may hold some weight. Gensler has evidently been much more critical of the broader crypto space but appears to have been dodging questions about warming up to Bitcoin.

In 2021, he acknowledged BTC as "a digital, scarce store of value." He pointed out that it is highly volatile and still needs greater guardrails for investor protection, but said he understands why traders are attracted to the asset. It was the same year he was confirmed by the Senate as the SEC chair.

Since then, he has barely spoken about the world's first decentralized cryptocurrency and launched a wide-reaching crypto crackdown.

Shortly after the SEC approved spot BTC exchange-traded funds (ETFs) in January, Gensler described Bitcoin as a "non-security commodity." He immediately reiterated that the SEC's decision in no way signals that the Commission is now willing to approve "listing standards for crypto asset securities."

Why is Gensler Talking Bitcoin Now?

Some crypto users on X are happy to receive more clarity and affirmation from Gensler, with some saying he has supposedly been fine with Bitcoin for the longest time but "only has [a] problem with ETH (Ether) and altcoins."

On the other hand, other crypto users argued that Gensler was only engaging in "damage control" as he supposedly fears getting "fired by [Donald] Trump one day." During the Bitcoin 2024 conference, the GOP presidential candidate said he will fire Gensler on his first day if he wins the November elections.

An After-Effect of Congress Pressure?

Gensler's affirmation of Bitcoin's status as a security came a day after he appeared at a House committee hearing where multiple lawmakers from both parties blasted his leadership and the SEC's crypto crackdown.

Ahead of the hearing, he was already under scrutiny by lawmakers for his enforcement-first and "politicized" approach to digital assets and the Commission's refusal to provide regulatory clarity for the sector.

Meanwhile, Bitcoin has been up by over 140% in the past year and even with its own ups and downs in recent months, it remains the world's top digital asset and has broken many financial barriers that traditional finance couldn't offer.