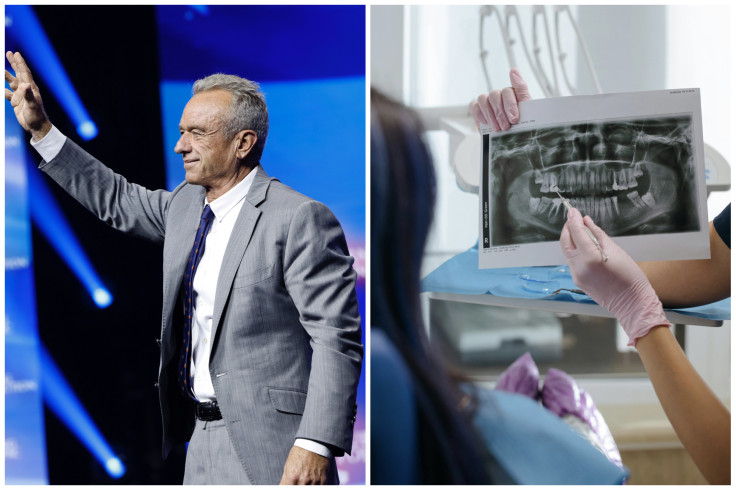

Dental care supply stock surged Monday amid speculation that President-elect Donald Trump's nominee for Health and Human Services (HHS) secretary, Robert F. Kennedy Jr., could push to eliminate fluoride from U.S. drinking water.

Dental care supplier Henry Schein had its best day since 2022 with a 7.5% jump in shares.

Kennedy, an outspoken critic of water fluoridation, has claimed a Trump White House would advise removing the mineral from public water systems. Fluoride, long shown to reduce cavities, has been a staple of public health programs for decades, but its removal could increase dental issues and spur more frequent dentist visits.

"The thought here is RFK will bring to HHS a voice that is in favor of reducing, or eliminating, the amount of fluoridation that is added to drinking water," Don Bilson, head of event-driven research at Gordon Haskett told CNBC. "This will, in turn, lead to an acceleration of tooth decay and more dental visits."

The prospect of such public health changes under Trump's second administration also boosted shares of other dental product makers, including Dentsply Sirona and Envista.

Kennedy's nomination rattled broader healthcare stocks last week, with pharmaceutical companies and health insurers sliding amid concerns about his history as a vaccine skeptic.

"It caused widespread selling across the healthcare landscape," Bilson said. "Drugmakers, contract research organizations, and health insurers all felt the quake. Rather than stop there, the damage spilled into packaged foods. And advertising."

Despite Wall Street's willingness to bet on shifts in consumer behavior, Bilson noted that any regulatory changes will take years to come into effect, and that drinking water is largely under the purview of the Environmental Protection Agency, not HHS.

© 2025 Latin Times. All rights reserved. Do not reproduce without permission.