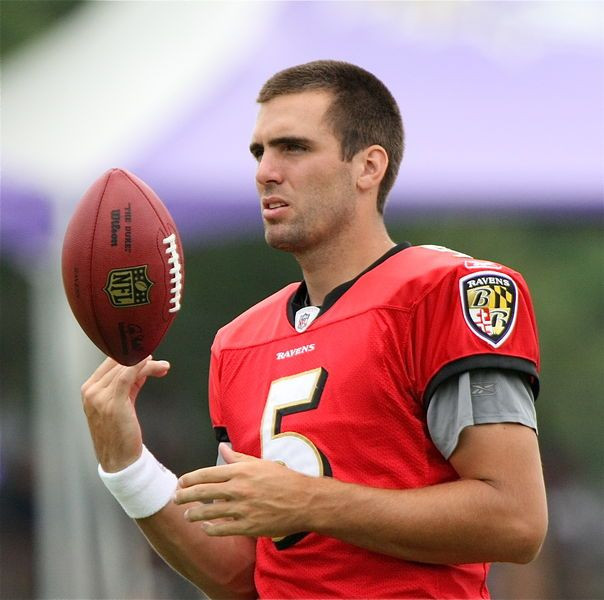

Superbowl champion quarterback Joe Flacco recently netted a much-reported $120 million contract over the next six years. Some say that is quite a lot for a few hours of fanfare.

But, he lives in Maryland, an increasingly progressive state with taxes that sometimes outrank the traffic. Drew Brees, who is in the second year of a five-year $100 million contract with the New Orleans Saints, is considered to gross the second highest salary in the NFL. Brees, however, lives in Louisiana, the polar opposite of the Old Line State when it comes to tax practices. It is home to an increasingly visible conservative governor, Bobby Jindal, who prides his state on being an affordable place to live and visit.

Combine Flacco's residency in Baltimore County and his financial responsibilities to Annapolis along with other minor taxes, he pays nearly 52 percent of his salary back to the government. He also plays in the AFC, or American Football Conference. Why is that important? A closer look at cities the Ravens routinely visit for games reveals he has and will more often play in Boston, Cleveland, Pittsburgh, New Jersey (the Jets), Buffalo, and occasionally two sports cities in high-tax California: San Diego and Oakland. According to FOX Nation, many places including Massachusetts, home of the New England Patriots, also require a "jock tax," and many cities require players pay income tax on earnings from away games.

Brees' Saints on the other hand will mainly deal with Georgia, Florida, and North Carolina within the length of a football season, all of which are all much more conservative tax states than those in Flacco's region. The NFC isn't entirely tax friendly though. Philadelphia and San Francisco have teams in that conference that the Saints may play from time to time.

"Americans for Tax Reform" created a chart laying out the tax savings Flacco would have received had he left the Baltimore Ravens and joined with a number of other teams in friendlier tax areas such as Dallas and Jacksonville, Fla. His average tax liability would have been in the $8 million range rather than his current $10 million plus liability in Maryland.

© 2025 Latin Times. All rights reserved. Do not reproduce without permission.